estate tax return due date canada

IRS Form 1041 US. The personal representative of the testator must ensure that income tax returns have been properly filed for the year preceding death and that any income earned between January 1 st and the date of passing of the deceased in the same calendar year is accounted for in the last return filed on behalf of the deceased.

When Are Taxes Due In Canada 2022 Our Guide On Important Deadlines

Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income.

. 13 rows Due Date for Estate Income Tax Return. However you may want to file the final return before that time. The return is due 3 months and 15 days after the last day of the fiscal year.

15 per 1000 for the remaining 190000 of the estate. The estate T3 tax return reports income earned after death. The due date for an estate return is 90 days after the year end of the estate.

When filing estate taxes IRS Form 706 is due within nine months of a decedents date of death but filing Form 4768 automatically grants a six-month extension. 31 2010 as the estate year-end. That would make March 31 2011 her T3 filing deadline.

Each type of deceased return has a due date. Form 1041 is used by a fiduciary to file an income tax return for every domestic estate or domestic trust for which he or she acts. The gift tax return is due on April 15th following the year in which the gift is made.

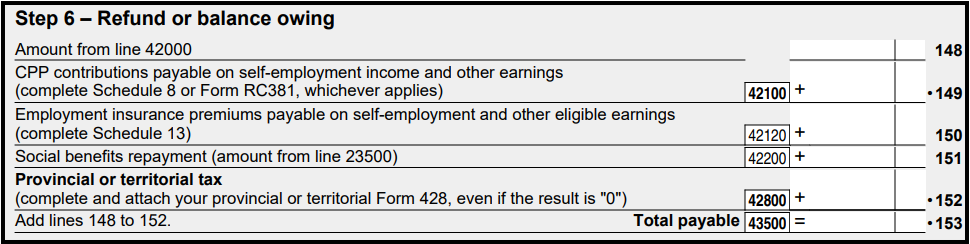

With an estate the tax year starts the day after the testators death and can continue for 12 months if the estate is a Graduated Rate Estate see next section or until Dec. Report income earned after the date of death on a T3 Trust Income Tax and Information Return. If you wind up a graduated rate estate the tax year will end on the date of the final distribution of the assets.

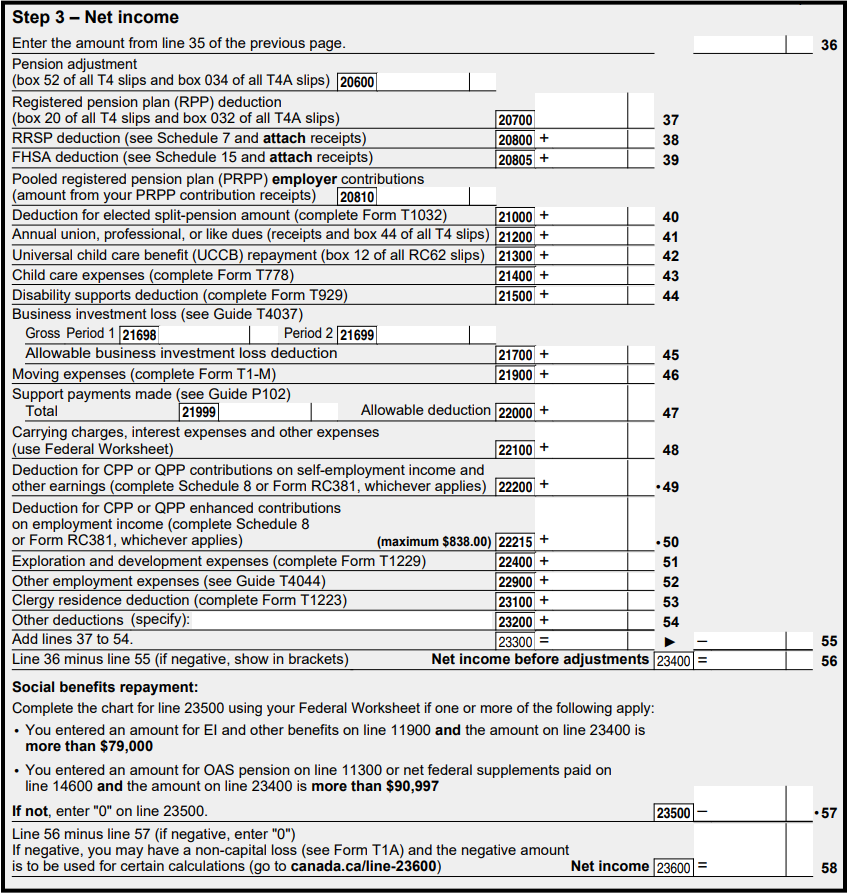

The tax period must end on the last day of a month. Final return due date if the death occurred between jan 1 st to oct 31 st the due date is april 30 th of the following year. 240000 - 50000 190000.

If you file in any month except December the estate has whats called a fiscal tax year instead of a calendar tax year. Estate tax forms rules and information are specific to the date of death. On the final return report all of the deceaseds income from January 1 of the year of death up to and including the date of death.

Income Tax Return for Estates and Trusts including recent updates related forms and instructions on how to file. The due date of the estate tax return is nine months after the decedents date of death however the estates. One of the following is due nine months after the decedents date of death.

The decedent and their estate are separate taxable entities. If you choose a fiscal year file a Form 1041 that covers the period May 2 2018 - April 30 2019. For example for an estate valued at 240000 the tax would be calculated as follows.

If the deceased persons estate earned income after the date of their death such as interest on a bank account or dividends from investments you may need to file a second income tax return Form 1041 for estates and trusts. For individuals the tax year is the same as the calendar year and the T1 is due April 30 for deaths before Nov. If the death occurred between November 1 and December 31 inclusive the due date for the final return is 6 months after the date of death.

ESTATE T3 RETURN. Final return For a graduated rate estate you have to file the final T3 return and pay any balance owing no later than 90 days after the trusts wind-up discontinuation date. For Individuals T1 personal returns are all technically due June 1st 2020 or June 15 th for self-employed individuals but the CRA will not assess late filing penalties and interest provided that the return is filed AND the taxes are paid.

Estate tax return due date canada. 31 for all other. If the deceased or the deceaseds spouse or common-law partner was carrying on a business in 2021 unless the.

Filing due date is April 30 for most taxpayers June 15 for self-employed and may vary for a deceased persons return Payment due date for 2021 taxes Pay your balance owing on or before April 30 to avoid interest and penalties find payment options to pay your taxes. The period from January 1 to December 15 the tax return is due June 15 of the following year. February 28 29 June 15.

In order to elect portability of the decedents unused exclusion amount deceased spousal unused exclusion DSUE amount for the benefit of the surviving spouse the estates representative must file an estate tax return Form 706 and the return must be filed timely. To get a clearance certificate as quickly as possible executrix Rita may be tempted to choose Dec. Generally the estate tax return is due nine months after the date of death.

A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. The deadlines to file a final return and pay any amounts owed for deceased persons are extended. Return extension payment due dates.

For T3 trust and estate returns with an original due date ending in June July or August the extended deadline is September 1st 2020. In this case the estate income. If you wind up an inter vivos trust or a testamentary trust other than a graduated rate estate you have to file the final T3 return and pay any balance owing no later than 90 days after the trusts tax year-end.

Before filing Form 1041 you will need to obtain a tax ID number for the estate. Note that the T3 filing deadline is 90 days after the year-end chosen by Rita. This final return is dubbed a terminal return.

Its due six months after death for deaths from Nov. Information about Form 1041 US. If the death occurred between nov 1 st to dec 31 st the due date is 6 months after the dod.

The period from january 1 to december 15. 0 per 1000 for the first 50000 of the estate. If it was between November 1st and December 31st its due six months after the date of death.

The return is due April 15 2019. Enter the wind-up date on page 1 of the return. You as executor can file the estates first income tax return which may well be its last at any time up to 12 months after the death.

190000 1000 190. The Estate Administration Tax is calculated on the total value of the estate. To pay the estate tax file the estate tax return and applicable addendumss or file an estimated payment with an extension.

An estates tax ID number is called an employer identification. Form 1041 is only required if the estate generates more than 600 in annual gross income. If you wind up a graduated rate estate the tax year will end on the date of the final distribution of the assets.

If the death occurred between January 1 and October 31 inclusive the due date for the final return is April 30 of the following year. If the death occurred between January 1st and October 31st you have until April 30th of the following year. For other forms in the Form 706 series and for Forms 8892 and 8855 see the related.

When are the returns and the taxes owed due. If the deceased died within the period from December 16 to December 31 the tax return is due six months after that date of death.

When Can I File My 2021 Taxes In Canada Loans Canada

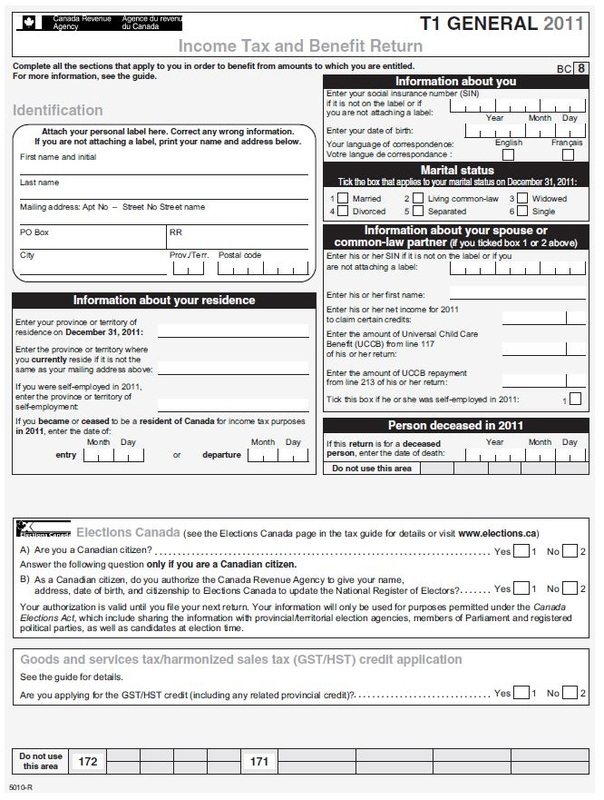

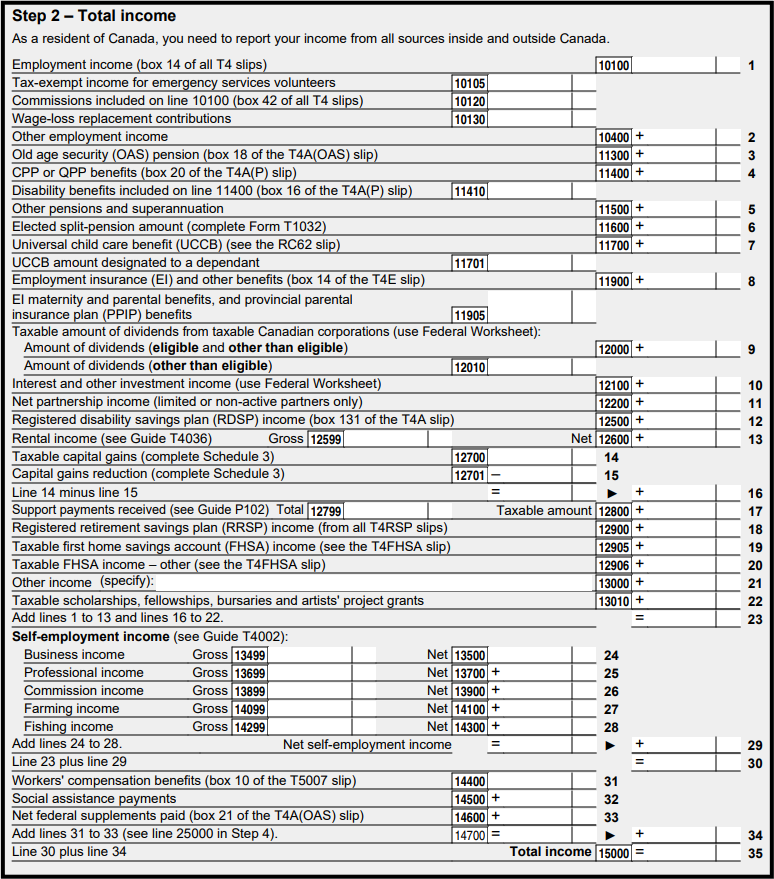

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

When Can I File My Taxes 2022 Tax Filing Deadline 2022 Turbotax Canada Tips

Filing The T3 Tax Return Advisor S Edge

Deceased Tax Returns In Canada What To Do When Someone Has Passed Away 2022 Turbotax Canada Tips

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Money Dates 2019 Ativa Interactive Corp Dating Dating Personals How To Plan

:max_bytes(150000):strip_icc()/1040-X2021-1f84c7ebdea2461ba2f7d9de9c6cb8ec.jpeg)

Form 1040 X Amended U S Individual Income Tax Return Definition

Need Your T1 General Tax Form Best Regina Mortgage Advice

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

When Can I File My 2021 Taxes In Canada Loans Canada

When Can I File My Taxes 2022 Tax Filing Deadline 2022 Turbotax Canada Tips

Filling Out A Canadian Income Tax Form T1 General And Schedule 1 Using 2017 As An Example Youtube

When Can I File My Taxes 2022 Tax Filing Deadline 2022 Turbotax Canada Tips

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

:max_bytes(150000):strip_icc()/1040-NR2021-59bde80441114cfa9cb43d182e899b8b.jpeg)

Form 1040 Nr U S Nonresident Alien Income Tax Return Definition